Following last month’s Newsletter reported waiver trifecta: UC report release; disallowance; and request for Texas to resubmit its 1115 waiver; this past month has been relatively calm. We do have some answers to some of the trifecta issues while HHSC is in preparation mode in advance of face to face waiver negotiation meetings with CMS later this month.

Answers in on:

Disallowance. CMS has indicated that the disallowance is a “test case.” CMS and HHSC discussed sending a test case for review months ago but HHSC had no heads up before receiving the disallowance notice. Even though it’s a test case, it’s an actual disallowance: unless overturned upon review or appeal, CMS will collect the disallowed funds from Texas. HHSC also indicated that it will seek a Secretarial review before pursuing an appeal through the federal HHS Departmental Appeals Board (DAB). HHSC also said at this point, if a review or appeal is not successful, HHSC can’t say how or from whom they’d seek repayment on the disallowance. HHSC had an October 7th association call on the disallowance to provide an update, seek support and obtain input. Because the outcome of the current disallowance could affect UC and DSRIP payments retroactively, HHSC sought input on whether the state should or should not continue making UC/DSRIP payments. For more information see THIS #1.

Another Application for Texas Waiver Renewal? HHSC will not be submitting another waiver application to CMS. CMS had requested, upon the advice of its legal team, that HHSC submit another waiver renewal application. The request reportedly caught HHSC, as well as CMS’ Deputy Administrator and Director for the Center for Medicaid and CHIP Services (CMCS) Vikki Wachino and Waiver Demonstrations Director Eliot Fishman by surprise. In any event, HHSC notified CMS last week that it does not intend to submit another renewal application (see HHSC letter to CMS’ Vikki Wachino); that its application will remain unchanged; and that it is seeking a face to face meeting later this month to move into substantive waiver negotiations with CMS. Executive Commissioner Smith hoped to have negotiations completed in December. HHSC wants to be prepared to bring to the legislature what CMS might require of Texas for a waiver renewal. For more on the waiver renewal see THIS #2

HMA Study Commissioner Smith spent nearly two hours with HMA UC report authors and hospital associations at a September MAWWG meeting to review the HMA UC REPORT.

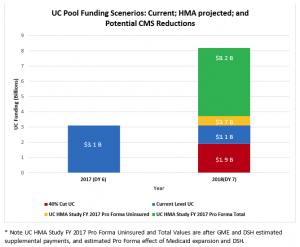

Commissioner Smith reviewed the state’s plan for negotiating the waiver renewal (see renewal above) and indicated that there is nothing substantive in the report with which HHSC will disagree. Pam McDonald, the Director of the Rate Analysis Division, noted that HMA accessed a huge amount of Medicaid data and did a great job analyzing it. We acknowledged HHSC’s role in creating and managing the UC/DSH data set, which provided a great data set for the Texas study, and that wasn’t available in other states. Florida, for example, that had to depend on the less reliable Medicare S-10 report. The graphic below (JESSICA’s) highlights data from the HMA study. It shows the estimated total amount of hospital uncompensated care in Texas for 2017 ($8.2 billion); the reported amount of uncompensated care related to hospital care for the uninsured ($3.7 billion); the current waiver UC funding ($3.1 billion) and the amount of UC remaining if CMS were to provide a reduction at the level they did in Florida, of 40% ($1.9 billion).

HMA estimates $8.2B in UC, $3.7B of which is for Uninsured Care. The remainder is for Medicaid shortfall. That compares to $3.1B in UC today and, for perspective, a 40% UC cut if CMS does what it did in Florida.

The $8.2 billion dollars of estimated UC from the report assumes a Medicaid expansion is in place, and considers Medicaid DSH payments made to offset hospital uncompensated care. Other key points from the report and discussion:

- The hospital reduction in uncompensated care under a Medicaid expansion was identified as only $358 million dollars in 2017. Hospital costs would go down from uninsured Texans having a payer source, but would go up related to crowd out: some insured Texans, presumably with commercial insurance and higher hospital payment rates, would drop current coverage and turn to Medicaid with lower hospital rates. In addition, HMA used a 60% participation rate to estimate the number of Texans eligible under an expansion who would actually enroll.

- What would it take to get Medicaid rates to equal the costs of care? About 3.1 billion dollars funded by an estimated $1.3 billion of state match.

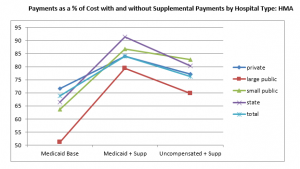

- HMA noted that there is $1 billion of IGT in the system related to DSH, UC and GME (and not including DSRIP IGT). While CMS considers IGT to be a part of reimbursement, HMA noted that for IGTing entities, expenditures for IGT reduce a contributor’s Medicaid revenue for operations and patient care. IGT should, HMA noted, be considered in reviewing payment adequacy. Even when IGT is not addressed, the HMA study showed that the large six IGT public hospitals have lower rates compared to other hospital types and the state total.

Payments as a % of Cost with and without Supplemental Payments by Hospital Type: HMA

THIS #1

Waiver Disallowance:

HHSC held an all-association phone call October 7th with the Executive Commissioner and staff on the waiver disallowance.

HHSC wanted to: provide an update to stakeholders and seek support and stakeholder input to CMS regarding the importance of the current financing system in Texas.

Brief Background:

- On 9/1/2016 HHSC received a notice that CMS is disallowing $26.8 M in federal funds. The amount was based on in-kind donations to the Dallas and Fort Worth hospital districts by the Dallas and Fort Worth Indigent Care Corporations; both of which are funded by private hospitals. The disallowance is for the federal fiscal quarter ending 12.31.2015. This followed a deferral in 2014 that was lifted; and CMS reviews of the financing in these two areas as well as Travis and Nueces counties.

- CMS has said this is a “test case,” the need for which was discussed previously with HHSC. CMS indicated verbally that it will not pursue other disallowances, but is not willing to put that in writing.

- HHSC has two options to request reconsideration: a review by the HHS Secretary (Burwell); or an appeal to a Departmental Appeal Board (DAB), appointed by the Secretary.

- The state has 60 days from the notice of the letter to request a review or appeal. If the state goes to the Secretary first, it can then go to the DAB for an appeal.

- The state need not repay the disallowance pending the outcome of the review/appeal; but would owe interest if CMS prevails.

Update

- HHSC plans to request a review by the Secretary of HHS of the disallowance decision and then consider going to the DAB by Oct. 28, 2016. Best case is a win and no disallowance, next best case is that CMS would only disallow going forward from the decision date. (Bad case is that CMS would retrospectively disallow).

- The $26.8M calculation is derived in a different way than the 2014 disallowance. 2014 was based on the value of federal funds in payments to providers. This $26.8 is based on the value of the contracts with the Indigent Care Corporations.

- CMS indicated that it would consider other disallowances or actions based on the outcome of the review/appeal of the current disallowance.

Seeking input

- HHSC asked stakeholders whether HHSC should continue making UC and/ DSRIP payments given the disallowance.

- The risks include: if CMS is ultimately successful, the state would need to repay the disallowed amounts. If CMS is able to disallow funds retrospectively prior to the Review/Appeal outcome, the state would be incurring risks related to the payments it makes that could subsequently be disallowed. Also, there would be some minimal interest on the federal funds disallowed but kept by the state.

- HHSC’s rate analysis director noted that in one way, providers can individually manage their risk regardless of the state’s decision, by not participating in those types of financing arrangements that incur this risk.

- HHSC said they haven’t yet resolved who would repay the disallowance or how that would be managed.

Seeking Support

- If anyone has thoughts to support HHSC’s request for review, HHSC will appreciate them. HHSC will be making the technical/legal arguments for the review.

- It would be very helpful for stakeholders to provide input to CMS and to those with input to CMS regarding the impact of this disallowance on the financing in Medicaid, for the safety net system, and for those receiving care through this system in Texas.

THIS #2 Waiver Renewal:

HHSC released through its stakeholder distribution list the HHSC Oct. 6, 2016 letter to CMS. The letter notifies CMS that the Commission’s original waiver renewal submission sent September 29, 2015 stands as the state’s request and the application remains unchanged. The Commissioner also asked CMS to schedule a face to face meeting in October to negotiate on a waiver renewal; and asked for CMS’ analysis of the HMA Uncompensated Care study prior to the meeting.

You will remember that HHSC was told in a call by CMS staff that HHSC would need to resubmit the waiver application. HHSC subsequently noted that this request was news to CMS leadership including Vicki Wachino and Eliot Fishman at CMS. The request by legal staff at CMS was made to ensure that CMS was following its own requirements. CMS leadership was reviewing this request.