THOT’s review this session of the 10,877 filed bills and active monitoring and/or engagement on 1,939 bills and related amendments focused on our core commitments including: GME and workforce; access to care, behavioral and women’s health; trauma; pharmacy and 340B; Medicaid financing; and local authority and responsibility. Beyond Individual member achievements, below are some of THOT’s major successes this Session:

Repeal of the DRP program & replacement with sustainable targeted funding.

In the 84th Session, THOT* was the first hospital association publicly supporting a repeal of the Driver Responsibility Program (DRP) if there was alternative “reliable, sustainable and targeted funding” for the trauma program. We worked with smart on crime, low-income advocacy, DPS, law enforcement and other groups that session. We acknowledged the negative impacts of the DRP program, particularly on lower income populations such as those for which THOT members have a special concern. This session, with the leadership of Chair Zerwas and Chair Huffman and broad stakeholder coalition support that included THOT, HB 2048 repealed the DRP program and replaced it with increased DWI and state traffic fines, and a $2 fee on insurance premiums. These changes address the unintended consequences of the DRP program particularly on low income Texans, while reliably funding critical trauma programs: a win/win.

Requiring Medicaid CHIP Appeals Unit to Follow Federal Coding Guidelines.

Also in the 84th Session, THOT worked on language requiring that HHSC Office of Inspector General audits follow federal coding guidelines. This longstanding issue was resolved when Senator Hinojosa’s OIG Sunset bill, including this requirement, was passed. Since then our members found that Medicaid/CHIP Appeals failed to follow federal coding guidelines in its appeals reviews of OIG’s audits, leaving hospitals with incompatible coding criteria and inaccurate Medicaid recoupments. To address this THOT convinced lawmakers to file SB 1458 and its House Companion, HB 3573. This month the Governor signed SB 2138, which contained the language from SB 1458/HB 3573 as an amendment, requiring the Appeals Unit to follow federal coding guidelines and aligning the OIG and MCD Appeals criteria. This should result in all Texas Medicaid hospitals benefitting from fewer inaccurate recoupments.

Ensuring Adequate Access to Hospital District Community Funding.

A goal of limiting homeowners’ rising property taxes led to SB 2/HB 2 limiting taxing entities’ ability to increase property taxes. THOT’s work with the House Ways & Means Committee highlighted the important and unique functions hospital districts provide in their communities; and health care’s different cost growth trends. We created and provided the committee with a hospital district credit proposal for valued services provided locally and statewide, e.g., supporting GME, trauma care, and DSH. The Committee Substitute subsequently exempted hospital districts, and THOT continued work with the Legislature through the process to support the needs and health contributions of Texas’ hospital districts. The bill as passed maintained the exemption, ensuring hospital districts’ ability to continue funding valued healthcare services.

* THOT includes not only our office staff, but our incredible member institutions’ Government Relations, Finance, Waiver, and executive resources and work and our partnering consultants.

Supporting Adequate State Analytic Capacity While Protecting Hospital Funding.

THOT’s Executive Committee committed to financially support improved HHSC rate analytic capacity. Yet according to the LBB, proposed language in SB2138 would have accessed 1% or $53 million annually of IGT-matched supplemental funding for state administration costs. THOT drafted language to limit the percentage of funds and apply a maintenance of effort provision so IGT funds could not be used to supplant existing HHSC costs e.g., for cost-containment or other uses. THOT’s work in partnership with THA, the bill author and HHSC resulted in the final bill protecting hospitals (safeguarding an est. $40M/year) while supporting HHSC’s analytic investments, by allowing HHSC to access up to $8 million a year, with the ability to petition the Legislative Budget Board for additional access to funding up to 0.25%. In addition, reporting requirements were added to guarantee HHSC is transparent in how it is spending these dollars. Finally, maintenance of effort language was included to preclude using local funds to pay for administrative costs previously covered by state GR.

Supporting Texas’ New and Existing GME programs

- New Medicaid Direct GME payments. In the 84th Session, THOT started work on a Medicaid GME program for existing public and private residency programs and positions. This session saw the first Medicaid GME payments made to non-state public teaching hospitals ($49.5M new federal/yr.), and publication of a rule implementing Medicaid GME payments for private teaching hospitals with payments to be effective for services starting during this session (April, 2019, $64M est. new federal in 2020). Texas now joins most other states in accessing budget neutral, federally available Medicaid support for our underfunded, existing residencies. These funds will help stabilize existing programs and support a foundation for needed growth in our Texas healthcare workforce.

- Indirect GME: Protecting Existing and Supporting New GME Programs. Texas funds Indirect GME using a Medicare methodology and point in time data. This approach harms new residency programs since once they apply for Indirect GME funding, future growth is excluded. HB 2798/SB 2238 sought annual updates to point in time data which would have harmed many existing residency programs to the tune of about $7.8M/year by using Medicare data that ignores residents above the 1996 cap levels. THOT supported growing hospitals, a hold harmless for existing hospitals, and a state study to identify updating factors that won’t penalize hospitals maintaining or growing residents. As a result, existing THOT hospitals avoided a loss of $3.7M/year. While the bill ultimately failed to pass, an HHSC study added to SB 1991 should develop an updated factor reflecting new hospitals’ residency growth without penalizing existing hospitals that maintain or grow their residencies.

- Additional New GME Grant Funding proposed by Texas Higher Education Coordinating Board and supported by THOT added $60 million to the Budget to continue and grow funding for new GME residency positions. (HB 1; Art. III rider).

- Increased GME formula funding for HRIs in the Budget went from $5,824 to $5,970 per resident per year (the estimated Medical School Faculty Cost of teaching and oversight of residents is about $18,000 – $20,000). THOT supported our HRIs in their requested increase. (HB 1).

Ensuring Accuracy in HHSC’s Legislative Uncompensated Care Reports.

Prior to this session, HHSC released its Legislatively required Uncompensated Care report. Its misleading conclusions included that Texas’ uncompensated care costs were going down and that public hospitals received payments at 110% of their uncompensated care costs. While HHSC’s report methodology was consistent with prior years, it nonetheless made inaccurate assumptions and drew erroneous conclusions. THOT detailed its concerns to HHSC, which believed that it was required to use a data source found to be problematic. THOT worked with the Legislature and HHSC during the session requesting that the most accurate hospital specific data source be used moving forward. The resulting UC Report rider in the Budget (HHSC Rider4) now clarifies that “HHSC may use the most accurate data available for each hospital.”

Latest Topics

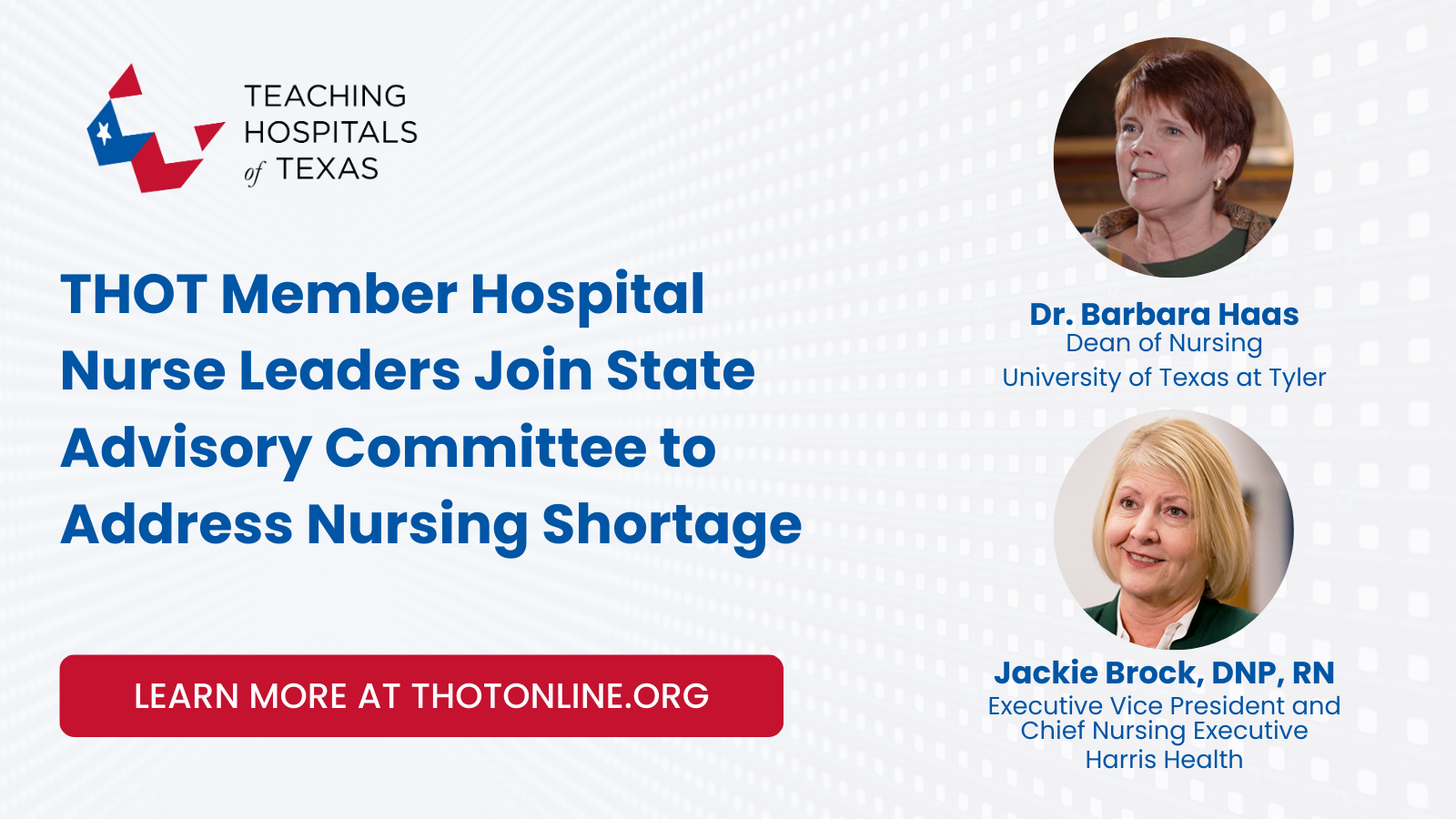

Nurse Leaders From THOT Member Hospitals Appointed to State Advisory Committee on Nursing Workforce Shortage

Nurse leaders from the University of Texas at Tyler and Harris Health [...]

Doctors’ Day 2024: Celebrating & Recognizing Our Dedicated Physicians

March 30 is Doctors’ Day, a day to celebrate and recognize the [...]

THOT Members Listed Among Top 100 Workplaces in 2024 by USA Today

THOT members Children’s Health and University Health were listed as top 100 [...]