| July 19, 2019 Rule information related to 86th Legislation | ||||

| Posted Date | Topic | Rule & Preamble | Rule Timelines | Comments (if any) |

| 1.12.2020 | Quality Metrics for CHIRP | Quality Metrics published for CHIRP. HHSC seeking input with a goal of narrowing down the metrics to be used.

Comprehensive Hospital Increased Reimbursement Program (CHIRP)

|

Remote Public Hearing at HHSC on Jan. 20th at 9:00 central | |

| 1.12.2020 | Quality Metrics for TIPPS | Quality Metrics published for TIPPS. HHSC seeking input with a goal of narrowing down the metrics to be used.

Texas Incentives for Physicians and Professional Services (TIPPS)

|

Remote Public Hearing at HHSC on Jan. 20th at 9:00 a.m. | |

| 12.25.2020 | Hospital Rate Increases: CHIRP, UHRIP and ACIA | Hospital Rate Increases – CHIRP, UHRIP, ACIA

https://www.sos.state.tx.us/texreg/pdf/backview/0101/0101prop.pdf

|

Comments due: Jan. 25, 2021 by 5:00 pm

Hearing 1.11 Register for public hearing, January 11th at 10:30 am CST here |

in process |

| 1.1.2021 | Physician payments in DSRIP transition program | Provider Payment – TIPPS https://www.sos.state.tx.us/texreg/archive/December252020/Proposed%20Rules/1.ADMINISTRATION.html#24

|

Comments due: January 31, 2021 by 5:00 pm

Hearing 1.11 Register for public hearing, January 11th at 11:30 am CST here Comments due 30 days after publication. |

in process |

| April 24, 2020 | Revises UC allocation | https://www.sos.state.tx.us/texreg/pdf/backview/0424/0424prop.pdf

Clarifies how UC allocation is calculated; provides for proportional distribution of IGT in the event of certain recoupments. |

Comments due by May 25th, 2002

email Subject: Comments |

|

| April 24, 2020 | Revises UHRIP | https://www.sos.state.tx.us/texreg/pdf/backview/0424/0424prop.pdf

Makes non-state owned Institutions for Mental Diseases (IMDs) eligible for UHRIP for patients under 21 and over 65; Limits UHRIP to only managed care utilization; and not fee for service (FFS). This will disadvantage hospitals with higher than average FFS utilization. |

Comments due May 25, 2020 | |

| July 19, 2019 | GME- Medicaid Private Hospital | ADOPTED: | ADOPTED Rule | THOT_Private GME_Comments on Proposed Rule 355.8058 |

| July 5, 2019 | Hospital Inpatient Rate increase for rural and children’s hospitals | PROPOSED:

See pages 6 – 16 at the link above. SUBCHAPTER J. PURCHASED HEALTH SERVICES DIVISION 4. MEDICAID HOSPITAL SERVICES 1 TAC §355.8052 The amendment to this rule is proposed to comply with the 2020-21 General Appropriations Act (Article II, H.B. 1, 86th Legislature, Regular Session, 2019, Rider 11 and Rider 28), which allocates certain funds appropriated to HHSC to provide 44 TexReg 3370 July 5, 2019 Texas Register increased inpatient reimbursement for rural hospitals. In addition, the amendments to the rule are proposed to comply with Senate Bill 500 (S.B. 500), which appropriates $50 million in general revenue funds for rate increases to Children’s Hospitals. THOT Summary:

|

Public Hearing: Public Hearing held July 8, 2019 9:00 at HHSC.

Written Comments Due August 5, 2019 Written comments on the proposal may be submitted to the HHSC Rate Analysis Department, 4900 North Lamar Blvd., Austin, TX 78714-9030 (Mail Code H-400); by fax to (512)-730-7475; or by email to [email protected]. To be considered, comments must be submitted no later than 31 days after the date of this issue of the Texas Register. |

|

Rule information related to 86th Legislation

Posted Date: July 19, 2019

Topic: GME- Medicaid Private Hospital

Rule & Preamble:

ADOPTED:

https://www.sos.state.tx.us/texreg/pdf/backview/0719/0719is.pdf

Rule Timelines:

ADOPTED Rule

Comments (if any):

THOT_Private GME_Comments on Proposed Rule 355.8058

Posted Date: July 5, 2019

Topic: Hospital Inpatient Rate increase for rural and children’s hospitals

Rule & Preamble:

PROPOSED:

https://www.sos.state.tx.us/texreg/pdf/backview/0705/0705prop.pdf

See pages 6 – 16 at the link above.

SUBCHAPTER J. PURCHASED HEALTH SERVICES DIVISION 4. MEDICAID HOSPITAL SERVICES 1 TAC §355.8052

The amendment to this rule is proposed to comply with the 2020-21 General Appropriations Act (Article II, H.B. 1, 86th Legislature, Regular Session, 2019, Rider 11 and Rider 28), which allocates certain funds appropriated to HHSC to provide 44 TexReg 3370 July 5, 2019 Texas Register increased inpatient reimbursement for rural hospitals. In addition, the amendments to the rule are proposed to comply with Senate Bill 500 (S.B. 500), which appropriates $50 million in general revenue funds for rate increases to Children’s Hospitals.

THOT Summary:

-

- Specifics regarding Children’s Hospital Supplemental add-on

- To comply with SB 500, which appropriates $50M in GR for rate increases for Children’s Hospitals.

- To be eligible, must meet definition of a children’s hospital on September 1, 2019 (so new Children’s hospitals will not be eligible).

- Effective for inpatient discharges occurring after August 31, 2019 and before September 1, 2020.

- Adds Children’s Hospital Supplement add-on to the list of add-ons for which Children’s Hospitals are eligible. Any children’s hospital is eligible to receive an increase to its base SDA for this add-on.

- Add-on amount equal to $1,128.18.

- Rural Hospitals

- No changes to definition.

- Effective September 1, 2019, the following changes are made to comply with Riders 11 and 28.

- Specifics regarding Children’s Hospital Supplemental add-on

- Inflate each rural hospital SDA using CMS PPS Hospital Market Basket through FY 2020 and then update again to reflect inflation from FY 2020 to FY 2021.

- Increase by an additional 6.25%.

- Create rural labor and delivery services alternative SDA which adds no less than $500 to each such paid claim.

Rule Timelines:

Public Hearing: Public Hearing held July 8, 2019 9:00 at HHSC.

Written Comments Due August 5, 2019

Written comments on the proposal may be submitted to the HHSC Rate Analysis Department, 4900 North Lamar Blvd., Austin, TX 78714-9030 (Mail Code H-400); by fax to (512)-730-7475; or by email to [email protected]. To be considered, comments must be submitted no later than 31 days after the date of this issue of the Texas Register.

Comments (if any):

<none>

Posted Date: tbd

Topic: tbd

Rule & Preamble:

tbd

Rule Timelines:

tbd

Comments (if any):

tbd

Latest Topics

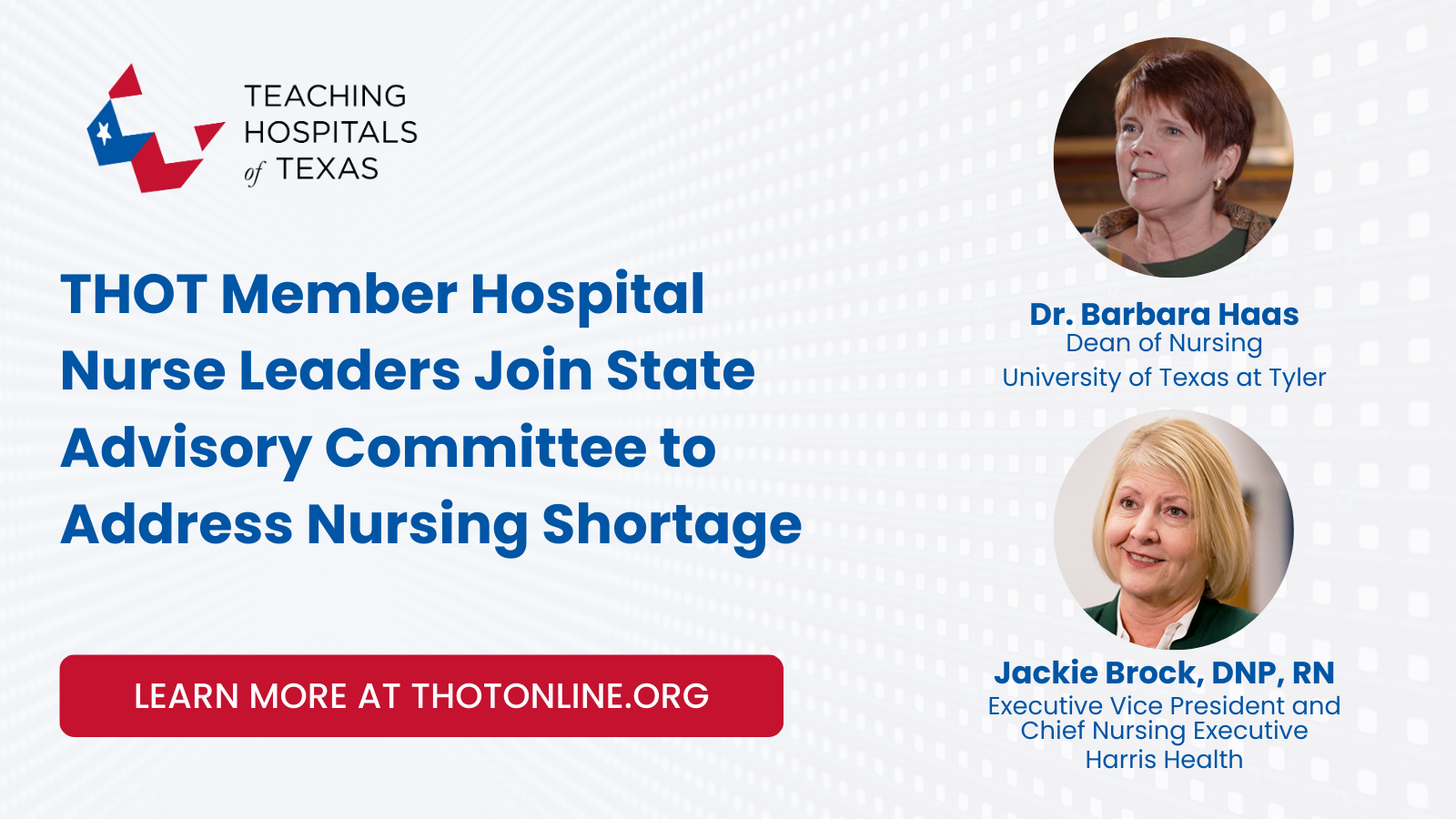

Nurse Leaders From THOT Member Hospitals Appointed to State Advisory Committee on Nursing Workforce Shortage

Nurse leaders from the University of Texas at Tyler and Harris Health [...]

Doctors’ Day 2024: Celebrating & Recognizing Our Dedicated Physicians

March 30 is Doctors’ Day, a day to celebrate and recognize the [...]

THOT Members Listed Among Top 100 Workplaces in 2024 by USA Today

THOT members Children’s Health and University Health were listed as top 100 [...]